- Market Views by Grinnell Capital, LLC

- Posts

- February is going to be very interesting!!!

February is going to be very interesting!!!

With the heart of earnings season upon us and a Fed decision imminent, early February will be packed with excitement.

February is Going to be Very Interesting!!!

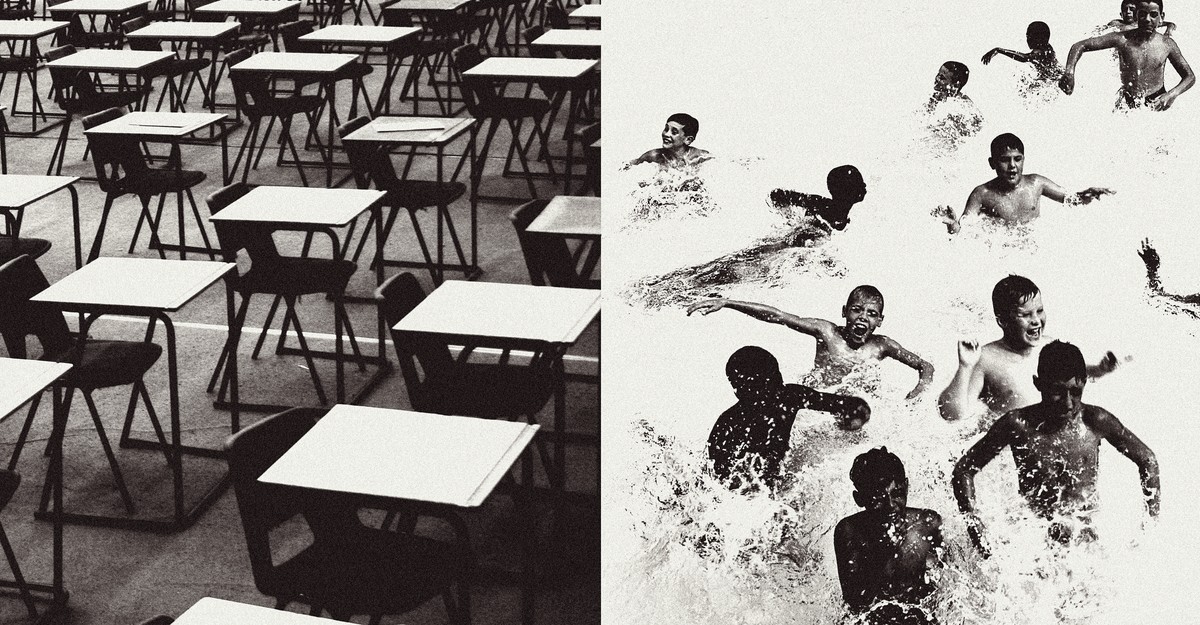

Here we go again. This is a very interesting day (1/23/23) to be writing this update, with the future aid of hindsight we’ll see that today either potentially marked the beginning of a new bull market or just another rally within the ongoing bear market. The S&P 500, measured here by the SPY ETF, has failed to the downside every time it has touched the downsloping red trend line, as you can see on the graph below from Schwab’s StreetSmartedge. Today’s test (teal arrow) of the red trend line is a bit unique in that it marks the first time the SPY has closed above both the trend line and the 200-day moving average (yellow line) as per Schwab’s StreetSmartEdge. I think speculative juices are starting to flow again in our stock market. My hunch is we see higher levels near term due to fund managers being underinvested and starting to feel like they are missing the boat! All this renewed enthusiasm may be met with sobering news on growth prospects in 2023 as companies report Q4 2022 earnings over the next several weeks. Not to mention the Federal Reserve has an interest rate decision meeting on Wednesday, February 1st. If the markets behave as I suspect between now and then, they take on a harsh, hawkish tone as their fight against inflation is being complicated by the loosening of monetary conditions due in part to the rally in our equity markets.

The Fed will also have to contend with the continued strength of the services component of our economy. We have mentioned this on several occasions, the strength seen in travel, hotels, restaurants, etc only feeds the inflation loop. The good news is on the “goods” side as prices continue to contract on all kinds of goods in the US. Our friends at Doubleline Capital have a great graph illustrating this dichotomy. In our opinion, the Fed is going to want to see both of these readings heading South! February 1st will be an interesting day indeed.

We continue to think that 2023 will be an extremely interesting year for investing outside of the US. Emerging markets have a forward P/E of around 12 according to Siblis Research. This is significantly cheaper than our S&P 500 with some important drivers. One of the biggest headwinds for emerging markets has been the US Dollar. The three-year graph below illustrates the inverse relationship, the dollar is represented by the ticker (UUP) has been weakening since last Fall. At the same time, emerging markets (EEM) has had a significant up move. We are looking for this trend to continue.

The US Dollar may very well continue to underperform as the Federal Reserve is likely reaching the end of their tightening cycle, in our opinion. Oftentimes the currency of a given nation has a strong correlation to the interest rate of that nation’s sovereign debt. Further, many countries, including the US, have found trading partners away from China as our relationship has soured a bit. The incremental gain for nations like India, Indonesia, and Vietnam will further drive emerging markets outside of China, in our opinion. We think China is interesting in of itself from a consumption perspective. With the nation finally moving past Covid lockdowns there is an enormous consumer with an appetite for experiences, dining out, travel, and recreation. One area worth exploring, in our opinion, is Chinese small caps. Inherently small-cap companies tend to be primarily domestic businesses. Just think about the Y/Y comps these Chinese companies will be lapping! Obviously, from a risk perspective, Chinese small-caps will have to make sense for your clients.

Animal spirits are making a comeback with the start of 2023. While its possible the chart of the S&P 500 at the top of this piece resolves itself to the upside, we do not believe our Federal Reserve thinks we are entirely out of the inflationary woods! Tread carefully and do not be afraid to own assets that do well in both a cyclical recovery and an inflationary environment, win, win! If you need help with these assets, reach out! [email protected] We are here to help!

Sincerely,

Frank & the Grinnell Capital team

Our Favorite Podcast of the Month

Articles we Enjoyed

Newsletter Friends

You may have noticed that we are using a new platform for this newsletter. One of our favorite features has been finding great publications. Check out our friend Graham's newsletter Grass Fed Investor. He writes about interesting topics and infuses his sense of humor!

|

IMPORTANT DISCLOSURES

For Financial Professional Use Only

Advisory services are offered through Grinnell Capital, LLC, a Utah Investment Advisor. This information is a general publication that reflects our opinion and is not a specific recommendation to any one individual. You must consult your own broker or investment adviser for investment advice.

This newsletter is provided for informational purposes only. The information contained herein should not be construed as the provision of personalized advice and is subject to change without notice. This material should not be considered as a solicitation to buy or sell any asset or engage in a particular investment strategy. Investing in securities involves the risk of loss, including loss of principal invested, and may not be suitable for all investors. Past performance is no guarantee of future results. This newsletter contains certain forward-looking statements which indicate future possibilities. Actual results may differ materially from the expectations portrayed in such forward-looking statements. As such, there is no guarantee that any views and opinions expressed in this newsletter will come to pass. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change without prior notice. Additionally, this newsletter contains information derived from third-party sources. Although we believe these sources to be reliable, we make no representations as to the accuracy of any information prepared by any unaffiliated third party incorporated herein and take no responsibility, therefore. This newsletter is provided with the understanding that Grinnell Capital, LLC is not engaged in rendering legal, accounting or tax services and we recommend that client seek out the services of professionals in these aforementioned areas.